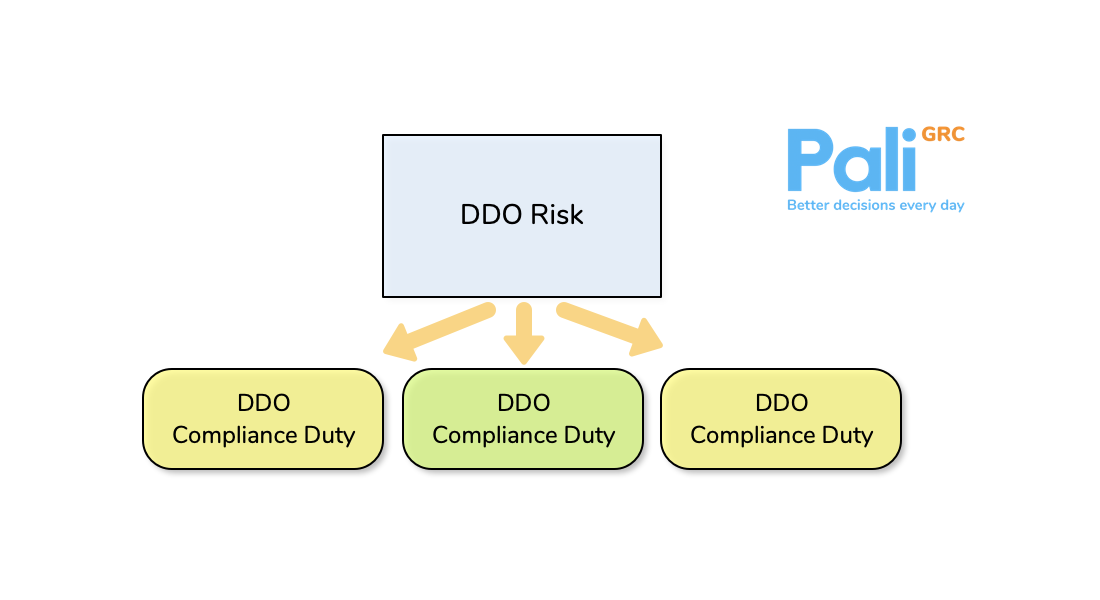

Risk management for DDO

The Design and Distribution Obligations (DDO) come into force on 5 October 2021

The regime is the biggest of the many big new things for the financial services industry in 2021 and will affect almost every part, including banks and other credit providers, superannuation providers, and insurers.

A New Obligations Regime

DDO requires issuers and distributors to have an adequate product governance system that will ensure products are targeted appropriately - and all issuers and distributors of almost all financial products must adhere to these strict new obligations. A product issuer or distributor may be subject to regulatory action for non-compliance, with compliance failure carrying both civil and criminal penalties.

According to a leading national commercial law firm, issuers and distributors of financial products will need to ensure an adequate risk management methodology is implemented to ensure that retail product distribution conduct is consistent with the product's Target Market Definition (TMD). Companies must review risk management and product monitoring policies and update them in relation to DDO obligations, processes and responsibilities.

Meeting ASIC Requirements

Here are some of the ASIC requirements relating to the DDO regime, and how the Pali GRC platform supports companies to fulfill their obligations and comply with those requirements:

Regular reviews to ensure suitability of the target market determination

Set up and review triggers and other related duties related to the target market determination directly into the Pali GRC platform to ensure products are suitable for the targeted consumers.

Set a product review cycle

Pali GRC enables your governance framework to be incorporated into your standard business process and operations. Set your review cycles and let Pali GRC’s workflow ensure that it is completed to standard and on time or escalated for supervisor attention.

Notify ASIC of significant breaches

Pali GRC will create and track breaches to the DDO regime and allow notification to ASIC along with the setup, tracking and reporting of all remedial activities.

Keep records of all related information and activity

Based on ASIC’s requirement, Pali GRC will keep complete records and an audit trail of all related activity in relation to DDO for seven years.

Pali GRC will help you comply with DDO

- Easy to keep up to date as policies change.

- Simple to manage your risk exposure.

- Low levels of training required.

- Built with bulletproof technology.

- Incident preparedness and tracking.

- Real-time reporting.

Please contact us to find out more and arrange a demonstration.